From Wikipedia, the free encyclopedia

In finance, the rule of 72, the rule of 70 and the rule of 69 are methods for estimating an investment's

doubling time. The rule number (e.g., 72) is divided by the interest

percentage per period to obtain the approximate number of periods

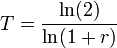

(usually years) required for doubling. Although scientific calculators and spreadsheet programs have functions to find the accurate doubling time, the rules are useful for mental calculations and when only a basic calculator is available.[1]These rules apply to exponential growth and are therefore used for compound interest as opposed to simple interest calculations. They can also be used for decay to obtain a halving time. The choice of number is mostly a matter of preference, 69 is more accurate for continuous compounding, while 72 works well in common interest situations and is more easily divisible. There are a number of variations to the rules that improve accuracy. For periodic compounding, the exact doubling time for an interest rate of r per period is

,

,

Using the rule to estimate compounding periods

To estimate the number of periods required to double an original investment, divide the most convenient "rule-quantity" by the expected growth rate, expressed as a percentage.- For instance, if you were to invest $100 with compounding interest at a rate of 9% per annum, the rule of 72 gives 72/9 = 8 years required for the investment to be worth $200; an exact calculation gives ln(2)/ln(1+.09) = 8.0432 years.

- To determine the time for money's buying power to halve, financiers simply divide the rule-quantity by the inflation rate. Thus at 3.5% inflation using the rule of 70, it should take approximately 70/3.5 = 20 years for the value of a unit of currency to halve.

- To estimate the impact of additional fees on financial policies (e.g., mutual fund fees and expenses, loading and expense charges on variable universal life insurance investment portfolios), divide 72 by the fee. For example, if the Universal Life policy charges a 3% fee over and above the cost of the underlying investment fund, then the total account value will be cut to 1/2 in 72 / 3 = 24 years, and then to just 1/4 the value in 48 years, compared to holding exactly the same investment outside the policy.

Choice of rule

The value 72 is a convenient choice of numerator, since it has many small divisors: 1, 2, 3, 4, 6, 8, 9, and 12. It provides a good approximation for annual compounding, and for compounding at typical rates (from 6% to 10%). The approximations are less accurate at higher interest rates.For continuous compounding, 69 gives accurate results for any rate. This is because ln(2) is about 69.3%; see derivation below. Since daily compounding is close enough to continuous compounding, for most purposes 69, 69.3 or 70 are better than 72 for daily compounding. For lower annual rates than those above, 69.3 would also be more accurate than 72.

| Rate | Actual Years | Rule of 72 | Rule of 70 | Rule of 69.3 | 72 adjusted | E-M rule |

|---|---|---|---|---|---|---|

| 0.25% | 277.605 | 288.000 | 280.000 | 277.200 | 277.667 | 277.547 |

| 0.5% | 138.976 | 144.000 | 140.000 | 138.600 | 139.000 | 138.947 |

| 1% | 69.661 | 72.000 | 70.000 | 69.300 | 69.667 | 69.648 |

| 2% | 35.003 | 36.000 | 35.000 | 34.650 | 35.000 | 35.000 |

| 3% | 23.450 | 24.000 | 23.333 | 23.100 | 23.444 | 23.452 |

| 4% | 17.673 | 18.000 | 17.500 | 17.325 | 17.667 | 17.679 |

| 5% | 14.207 | 14.400 | 14.000 | 13.860 | 14.200 | 14.215 |

| 6% | 11.896 | 12.000 | 11.667 | 11.550 | 11.889 | 11.907 |

| 7% | 10.245 | 10.286 | 10.000 | 9.900 | 10.238 | 10.259 |

| 8% | 9.006 | 9.000 | 8.750 | 8.663 | 9.000 | 9.023 |

| 9% | 8.043 | 8.000 | 7.778 | 7.700 | 8.037 | 8.062 |

| 10% | 7.273 | 7.200 | 7.000 | 6.930 | 7.267 | 7.295 |

| 11% | 6.642 | 6.545 | 6.364 | 6.300 | 6.636 | 6.667 |

| 12% | 6.116 | 6.000 | 5.833 | 5.775 | 6.111 | 6.144 |

| 15% | 4.959 | 4.800 | 4.667 | 4.620 | 4.956 | 4.995 |

| 18% | 4.188 | 4.000 | 3.889 | 3.850 | 4.185 | 4.231 |

| 20% | 3.802 | 3.600 | 3.500 | 3.465 | 3.800 | 3.850 |

| 25% | 3.106 | 2.880 | 2.800 | 2.772 | 3.107 | 3.168 |

| 30% | 2.642 | 2.400 | 2.333 | 2.310 | 2.644 | 2.718 |

| 40% | 2.060 | 1.800 | 1.750 | 1.733 | 2.067 | 2.166 |

| 50% | 1.710 | 1.440 | 1.400 | 1.386 | 1.720 | 1.848 |

| 60% | 1.475 | 1.200 | 1.167 | 1.155 | 1.489 | 1.650 |

| 70% | 1.306 | 1.029 | 1.000 | 0.990 | 1.324 | 1.523 |

History

An early reference to the rule is in the Summa de Arithmetica (Venice, 1494. Fol. 181, n. 44) of Luca Pacioli (1445–1514). He presents the rule in a discussion regarding the estimation of the doubling time of an investment, but does not derive or explain the rule, and it is thus assumed that the rule predates Pacioli by some time.| “ | A voler sapere ogni quantita a tanto per 100 l'anno, in quanti anni sarà tornata doppia tra utile e capitale, tieni per regola 72, a mente, il quale sempre partirai per l'interesse, e quello che ne viene, in tanti anni sarà raddoppiato. Esempio: Quando l'interesse è a 6 per 100 l'anno, dico che si parta 72 per 6; ne vien 12, e in 12 anni sarà raddoppiato il capitale. (emphasis added). | ” |

| “ | In wanting to know of any capital, at a given yearly percentage, in how many years it will double adding the interest to the capital, keep as a rule [the number] 72 in mind, which you will always divide by the interest, and what results, in that many years it will be doubled. Example: When the interest is 6 percent per year, I say that one divides 72 by 6; 12 results, and in 12 years the capital will be doubled. |

Thanks to :

Wiki